Shri Dhirendra Mani Tripathi hold a Master’s degree in Culture & Archaeology from University of Allahabad and a Bachelor degree in Science from St. Andrew’s College, University of Gorakhpur. Throughout his career, he has served in various capacities gaining experience in tax administration and policy implementation. With posting across multiple locations, including Porbandar, Delhi, Mumbai, Thane, Belapur & Gurugram. Shri Tripathi has demonstrated adaptability, leadership, and a deep understanding of complex administrative challenges.

Contact: 0755-2995943

Email: appeal-bhopal@gov.in

| Officer's Name | Designation | Phone No. | Email ID |

|---|---|---|---|

| Shri Dhirendra Mani Tripathi | Commissioner Appeals | 0755-2995943, 0755-2995942 |

appeal-bhopal@gov.in commrappeal@gmail.com |

| Shri G. Manigandasamy | Additional Commissioner Appeals | - | - |

| Smt. Gauravi Dubey Prabhudesai | Joint Commissioner Appeals | - | - |

| Shri Sharad Kumar Tripathi | Superintendent | - | - |

| Shri Vivek Bhatnagar | Superintendent | - | - |

| Shri Prabhat Khanna | Superintendent | - | - |

| Shri Aditya Sharma | Superintendent | - | - |

| Shri Anil Bhokre | Superintendent | - | - |

| Shri Ajay Mafidar | Superintendent | - | - |

| Shri Gaurav Verma | Superintendent | - | - |

| Smt. Neha Sharstri | Superintendent | - | - |

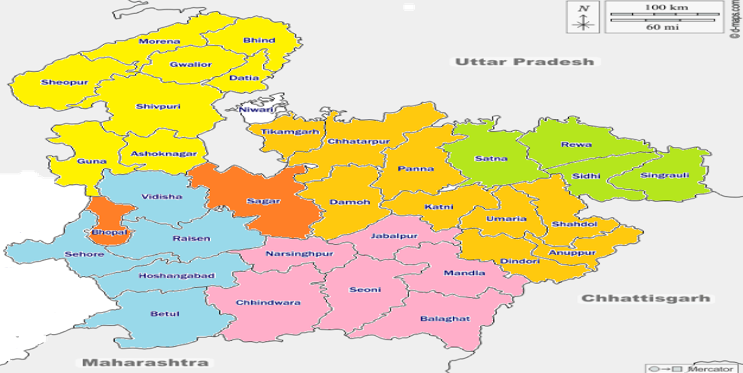

Appeals Commissionerate Bhopal

Covers Bhopal & Jabalpur Cgst Commissionerates

Help Desk

Help DeskRCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

RCM is payable?

Dealer migrated PAN

We get new GSTIN?

GST Law

Register in GST

Existing taxpayer register

On exiting, all chat history will be cleared

Your feedback matters!